Covid

Tax Credit – for Employers

The stimulus package, the Coronavirus Aid, Relief, and Economic Security (CARES) Act has so many parts. One has created a new employee retention tax credit for employers who are closed, partially closed, or experiencing significant revenue losses as a result of COVID-19. Find out: Who’s eligible How much will the tax credit be? Which employees…

Read MoreLaid Off?

Unemployment has seen a massive spike with Covid-19, but efforts at relief are making it slightly less painful. If you have lost your job, then read on. The CARES Act provides businesses with an incentive to retain employees through the PPP (Paycheck Protection Program). Additionally, Unemployment Insurance is now said to be on steroids. For…

Read MorePPP Overview and Application

The Department of Treasury has posted more information on the Payment Protection Program. In effect, it highlights the assistance it gives to small businesses. The site features specific info for both borrowers and lenders. An overview and application are also available. According to the SBA website, lenders may start processing applications on Friday, April 3…

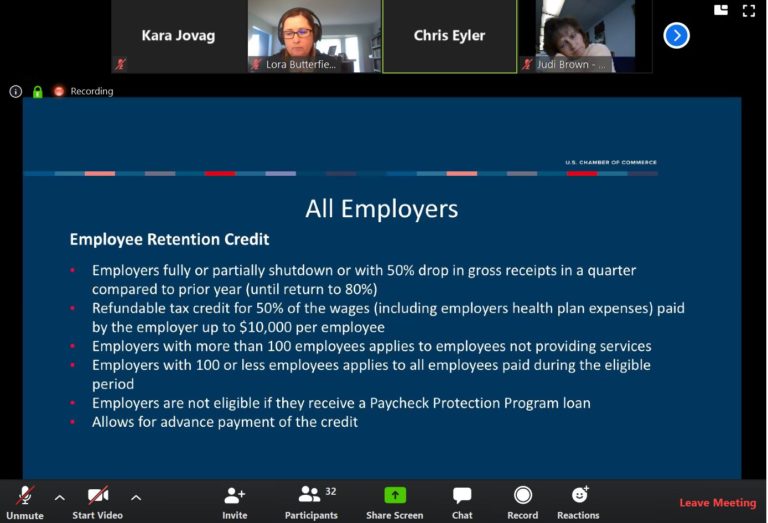

Read MoreCovid-19 Business Information Meeting

The FME Chamber just finished our Zoom meeting with Chris Eyler. He is from the US Chamber of Commerce. Gary Westcott, from Pierce County Economic Development joined as well. They shared some great information that summarized much of what is on the minds of business owners these days. The CARES (Coronavirus Aid, Relief, and Economic…

Read MoreCARES Act

With the $2.2 trillion stimulus package signed today, there is tremendous relief available for small businesses, who are struggling to keep their employees on payroll. Congress has approved the Coronavirus Aid, Relief, and Economic Security (CARES) Act. It allocates $350 billion in emergency loans for small businesses to help them keep workers employed. In fact,…

Read More