Economic Development

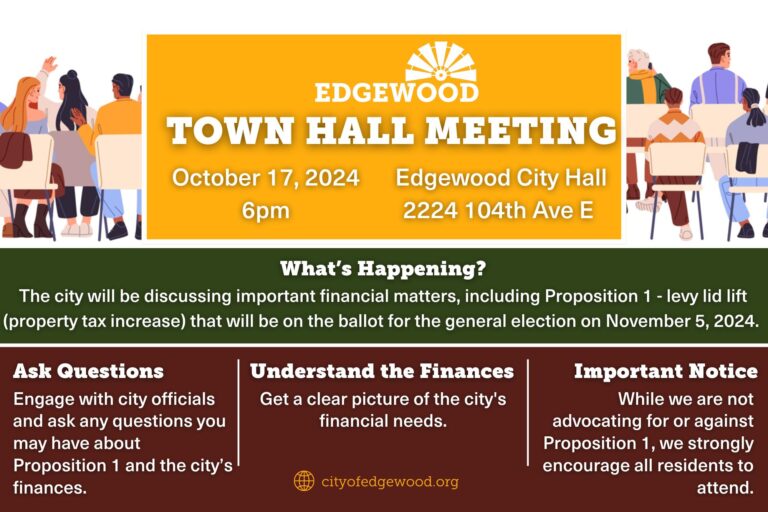

City of Edgewood Town Hall

The City of Edgewood invites the public to an open house at City Hall for a Town Hall Meeting to discuss important financial matters including Proposition 1. Proposition 1 allows a levy lid lift – a property tax increase. This will be on the ballot on November 5, 2024. Please attend on October 17, 2024…

Read MoreYou can welcome Sherwin Williams on September 18, 2024

The Fife Milton Edgewood Chamber of Commerce is delighted to welcome Sherwin Williams to the community on Wednesday, September 18, 2024. Chamber ambassadors, chamber members, and other community leaders will join together at 11:00 a.m. for a ribbon-cutting ceremony. Please join us. Location Sherwin Williams2600 Milton Road | Milton, WA 98354

Read MoreSeptember 24, 2024 – Ribbon cutting at Hops n Drops

Hops n Drops, “A Neighborhood Gathering Place,” is excited to announce the opening of its 22nd restaurant in Milton, Washington. This newest addition will be located in the Edgewood community, just off Milton Way, in Surprise Lake Square. The Fife Milton Edgewood Chamber of Commerce will welcome them with a ribbon cutting ceremony on September…

Read MoreGet to know your ABCs

We’re excited to launch our FME Chamber Ambassador Program on August 6, 2024. We believe we are business champions. We help your business grow through advocacy, promotion, and networking opportunities with the FME Chamber. Our Ambassadors are key to your business growth and promotion. Please join us and learn more.

Read MoreShort-term Extension of Property Tax

A short-term extension of property tax may be a bit of relief for certain businesses. Businesses that can show a loss of a quarter of their revenues due to Covid can apply for the extension. Additionally, qualifying businesses will not need to pay penalties or interest. To request an extension and a payment plane, be…

Read More